Last Updated: December 20, 2025

Recent Market Updates

- Gold currently trading at $4,326.15 per troy ounce as of December 20, 2025

- The 1894-S Barber Dime realized $2.16 million at the Florida United Numismatists Show in January 2025

- 1870-S Three-Dollar Gold Piece achieved $5.52 million at Stack’s Bowers auction in December 2025

What if a single dime from the San Francisco Mint could sell for over $2 million? That’s not a fantasy—it’s the stunning reality of the S-mint rarities market. The San Francisco Mint has produced some of the most expensive coins ever sold at auction, with pieces regularly commanding seven-figure sums that rival Wall Street art collections. From Gold Rush-era double eagles to the legendary 1894-S Barber Dime, these branch-mint treasures represent the pinnacle of American numismatics.

The highest price for antique coins San Francisco has ever produced recently shattered expectations. In the heart of the Financial District and near Union Square, collectors and investors are discovering that certain S-mint pieces can compete with—or even surpass—iconic Philadelphia rarities. Understanding which San Francisco coins achieve record prices, and why, is essential for anyone considering entering this elite market segment. Whether you’re exploring opportunities to sell coins in San Francisco or simply appreciate numismatic history, these auction records tell a compelling story.

Quick Answer: What Are the Most Expensive San Francisco Mint Coins?

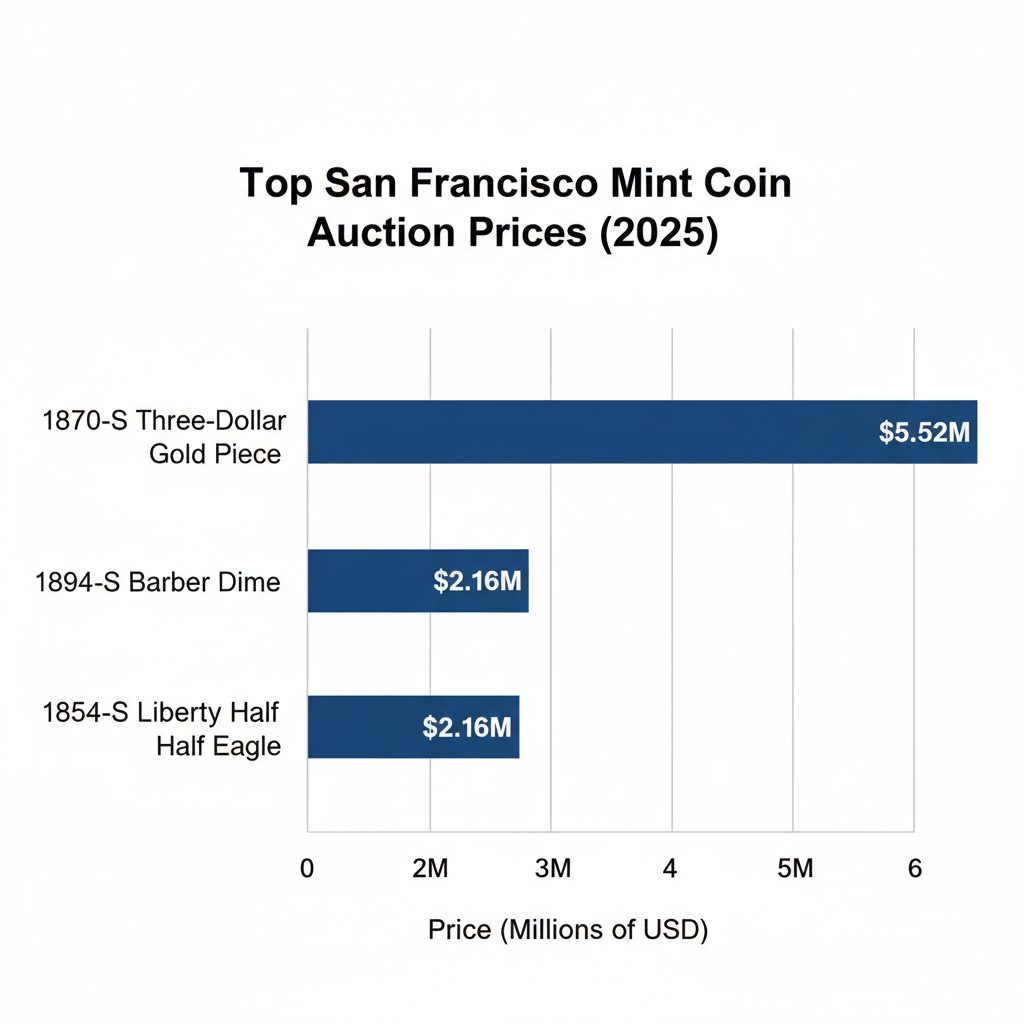

The highest price for antique coins from San Francisco includes the 1870-S Three-Dollar Gold Piece at $5.52 million, the 1894-S Barber Dime at $2.16 million, and the 1854-S Liberty Half Eagle at $2.16 million. These branch-mint rarities achieve their astronomical values through extreme scarcity, exceptional grades, and compelling historical narratives.

Key Takeaways:

- San Francisco Mint rarities consistently achieve multi-million dollar prices at major auctions

- The 1894-S Barber Dime is among the “Big Three” U.S. coin rarities with only 8-10 survivors

- Top five PCGS-certified auction coins in 2025 totaled $13.56 million combined

- S-mint gold coins from the 1850s-1870s era represent some of the highest values

- Professional certification by PCGS or NGC is essential for maximum value realization

The San Francisco Mint Legacy: Where Multi-Million Dollar Coins Are Born

The San Francisco Mint occupies a unique position in American coinage history. Established during the Gold Rush era, the facility at Fifth and Mission Streets produced coins that would eventually become the most sought-after pieces in numismatics. Our teams working with collectors throughout the Marina District and Pacific Heights regularly encounter S-mint pieces, though specimens capable of achieving auction records are extraordinarily rare.

What makes San Francisco Mint coins command the highest prices for antique coins? The answer lies in a perfect storm of factors: extremely low mintages, branch-mint proof status for certain issues, survival rates that sometimes reach single digits, and connections to pivotal moments in American monetary history. When these elements combine with exceptional preservation and PCGS or NGC certification, values can skyrocket into the millions.

Gold Rush Era Rarities and Their Modern Values

The 1850s and 1860s produced S-mint gold coins that today represent numismatic blue chips. The 1854-S Liberty Half Eagle, for instance, realized $2.16 million at Heritage Auctions in August 2018. These early San Francisco gold issues benefited from limited production capacity, high circulation rates that destroyed most examples, and the subsequent rarity that collectors prize above nearly all else.

The 1870-S Three-Dollar Gold Piece stands as perhaps the ultimate S-mint gold rarity. Its $5.52 million auction price at Stack’s Bowers in December 2025 makes it one of the most expensive American coins ever sold—branch-mint or otherwise. This demonstrates that San Francisco pieces aren’t secondary to Philadelphia issues; they can lead the entire market when rarity, condition, and demand align.

The 1894-S Barber Dime: A $2 Million Legend

No discussion of San Francisco coin values is complete without the legendary 1894-S Barber Dime. With only 24 pieces struck and approximately 8-10 survivors, this branch-mint proof stands among the “Big Three” U.S. rarities alongside the 1804 Silver Dollar and 1913 Liberty Head Nickel. The PCGS PR66 example that sold for $2.16 million at the Florida United Numismatists Show in January 2025 underscores the enduring demand for this tiny masterpiece.

The mystery surrounding why only 24 examples were produced adds to its allure. Some numismatic historians believe they were struck as presentation pieces or favors for influential collectors. Regardless of origin, this dime’s repeated multi-million dollar sales demonstrate that the highest price for antique coins from San Francisco can rival any rarity in American numismatics. Professional coin appraisals in San Francisco become crucial when dealing with potential rarities of this caliber.

Common Mistakes When Evaluating High-Value S-Mint Coins

The difference between a five-figure coin and a seven-figure masterpiece can be extraordinarily subtle. We’ve observed collectors in neighborhoods from Nob Hill to the Embarcadero make critical errors that cost them substantial value or lead to poor purchasing decisions.

Overlooking Certification and Provenance

The top auction results for San Francisco rarities invariably feature coins certified by PCGS or NGC, often with CAC (Collectors Acceptance Corporation) endorsements. An uncertified 1894-S Barber Dime—should one ever surface—would face tremendous scrutiny and likely sell for a fraction of a certified example’s value, regardless of its actual authenticity.

Provenance matters equally. Coins with documented ownership chains through famous collections like Eliasberg, Norweb, or Simpson command premiums. These pedigrees provide authentication, establish market history, and connect pieces to the numismatic narrative that serious collectors value. Ignoring certification and provenance when pursuing million-dollar coins is a costly mistake.

Misunderstanding Population Reports and Rarity

PCGS population reports reveal that the top-selling coins of 2025 each have certified populations ranging from just 3 to 14 examples. Many collectors fail to distinguish between “scarce” and “rare.” A coin with 500 examples in a particular grade is scarce; a coin with 8 total survivors is transcendently rare. This distinction drives the difference between $10,000 coins and $2 million treasures.

When considering coin buyers who provide written appraisals, ensure they reference current population data and understand how mintage versus survival rates affect value. An 1894-S dime isn’t valuable simply because 24 were struck—it’s valuable because fewer than 10 still exist.

Focusing Solely on Mintage Numbers

Low mintage doesn’t automatically equal high value. Condition, eye appeal, strike quality, and market demand all play crucial roles. Some S-mint coins with relatively low mintages sell for modest sums because most examples survived in high grades, while others with higher mintages command premiums due to abysmal survival rates or specific collector demand within series-specific registry sets.

Best Approach: How to Position San Francisco Rarities for Maximum Value

Achieving record prices requires strategic preparation. The coins that set auction records don’t reach those heights by accident—they’re positioned carefully through expert evaluation, proper certification, and presentation to the right buyer pool.

Professional Certification Is Non-Negotiable

Every coin in the million-dollar tier carries PCGS or NGC certification. For San Francisco rarities, this means submitting coins to these services with appropriate documentation, choosing the right service level (often requiring special handling for potential seven-figure coins), and potentially pursuing CAC review for additional market validation.

Our experience working with collectors near the Presidio and Richmond District has shown that certification costs—even premium service tiers—represent tiny fractions of the value enhancement proper grading provides. A coin that might achieve $50,000 raw could realize $200,000 or more in a holder with the right grade and pedigree information.

Choose the Right Auction House and Timing

Record-breaking San Francisco coins appear in sales by Heritage Auctions, Stack’s Bowers, and other major numismatic auction houses. These firms provide access to the global collector base willing to pay seven figures. The Florida United Numismatists Show, the American Numismatic Association conventions, and other major shows offer timing advantages that maximize bidder participation.

Market timing matters too. The top five PCGS coins of 2025 totaled $13.56 million combined—nearly double the $7.62 million combined total for 2024’s top five. Understanding market cycles, precious metals prices (gold at $4,326.15 per troy ounce as of December 20, 2025), and collector enthusiasm helps optimize sale timing. Learning about San Francisco coin dealers and the Gold Rush legacy markets provides crucial context.

Document Every Detail and Enhancement

High-resolution photography, detailed provenance research, and comprehensive lot descriptions all contribute to achieving maximum prices. Auction catalogs for million-dollar coins often include multi-paragraph descriptions covering strike characteristics, surface preservation, historical context, and previous ownership. This documentation transforms a coin from a mere object into a piece of American history worth millions.

Market Analysis: Recent Trends in San Francisco Coin Values

The numismatic market has shown remarkable strength at the ultra-high end. Data from major auction houses reveals important patterns for collectors and investors evaluating San Francisco rarities.

| Year | Combined Top 5 PCGS Coins | Notable S-Mint Sales |

|---|---|---|

| 2021 | $51.51 million | Record year overall |

| 2024 | $7.62 million | Market consolidation |

| 2025 (through Nov) | $13.56 million | 1894-S dime $2.16M; 1870-S $3 gold $5.52M |

This resurgence in 2025 demonstrates renewed confidence among ultra-high-net-worth collectors. The nearly 78% increase from 2024 to 2025 suggests strong demand for the highest price antique coins San Francisco has produced, particularly when backed by impeccable provenance and certification.

The Role of Precious Metals Prices

While numismatic premiums drive values for extreme rarities, underlying gold and silver prices provide psychological support. With gold at $4,326.15 per troy ounce as of December 20, 2025, collectors see tangible assets with significant intrinsic value plus numismatic premiums that can multiply base metal value hundreds or thousands of times.

For million-dollar coins, the metal value becomes almost irrelevant—an 1894-S dime contains about $0.04 of silver at current prices of $65.38 per troy ounce. Yet this underscores how pure rarity and collector demand create value independent of bullion content, a principle that defines the highest tier of numismatics.

Frequently Asked Questions About High-Value San Francisco Coins

What is the most expensive San Francisco Mint coin ever sold?

The 1870-S Three-Dollar Gold Piece holds the record at $5.52 million, sold through Stack’s Bowers in December 2025. This branch-mint gold rarity represents the pinnacle of S-mint values and ranks among the most expensive American coins of any origin.

Why did only 24 examples of the 1894-S Barber Dime get struck?

The exact reason remains debated. Numismatic historians suggest they may have been presentation pieces, examples struck to balance mint accounts, or gifts to influential collectors. The mystery enhances the coin’s appeal and contributes to its multi-million dollar valuation.

How can I tell if my San Francisco coin is valuable?

Look for key date combinations (1894-S dimes, 1854-S half eagles, 1870-S gold pieces), exceptional condition, and any unusual characteristics. However, professional evaluation is essential. Coins worth six or seven figures require expert authentication and certification by PCGS or NGC.

Do modern San Francisco Mint coins have similar value potential?

Modern S-mint proof coins typically carry modest premiums over bullion value. The 2025 Silver American Eagle S-Mint Proof marks the final proof Silver Eagle from San Francisco, which may drive future collectability, but true rarity develops over decades or centuries as coins are lost, damaged, or otherwise removed from the collectible population.

What role does San Francisco play in today’s coin market?

San Francisco, CA remains central to U.S. numismatics as a major collecting hub with deep historical connections to coinage. The city’s dealers, collectors, and auction presence—particularly near Union Square and the Financial District—make it a key market for both buying and selling significant pieces.

Conclusion: The Enduring Appeal of San Francisco Rarities

The highest price for antique coins from San Francisco reflects more than just market trends—it represents the intersection of American history, extreme rarity, and the timeless appeal of tangible wealth. From the $5.52 million 1870-S Three-Dollar Gold Piece to the legendary $2.16 million 1894-S Barber Dime, these S-mint treasures prove that branch-mint coins can compete with any rarity in numismatics.

For collectors and investors, understanding what drives these extraordinary values provides crucial context. Extreme scarcity, impeccable certification, compelling provenance, and exceptional eye appeal separate five-figure coins from seven-figure masterpieces. As 2025’s auction results demonstrate, demand for the finest San Francisco rarities remains robust, with prices nearly doubling year-over-year at the ultra-high end.

Whether you’re considering entering this elite market segment or evaluating pieces you may already own, professional guidance is essential. The numismatic landscape requires expertise that takes years to develop, particularly when dealing with coins that could represent life-changing values. The San Francisco Mint’s legacy continues to produce record-breaking results—a testament to the enduring power of true rarity in an increasingly digital world.

Sources and References

- San Francisco Mint – Wikipedia

- List of Most Expensive Coins – Wikipedia

- Heritage Auctions – Major numismatic auction results 2016-2025

- Stack’s Bowers Galleries – Rare coin auction records

- PCGS Population Reports and Market Analysis

- Professional Coin Grading Service (PCGS) certified auction data

- Numismatic Guaranty Corporation (NGC) grading standards

Financial Disclaimer: This article is for informational purposes only and does not constitute investment advice. Coin values fluctuate based on market conditions, condition, certification, and other factors. Past auction results do not guarantee future performance. Consult with qualified numismatic professionals before making significant buying or selling decisions.